Executive summary

Total past-due balance stayed in a narrow band: $16.63M MXN (Jan) → $15.78M (Mar) → $16.51M (Sep).

Long-term balances (>4 quarters) drive most of what’s owed: 85–86% of total each period.

By September, debt is concentrated in Baldío (vacant lots) and Condominio (condo): together ~69% of total.

Slips de Marina: no delinquencies appeared in the 2025 datasets.

Key KPIs

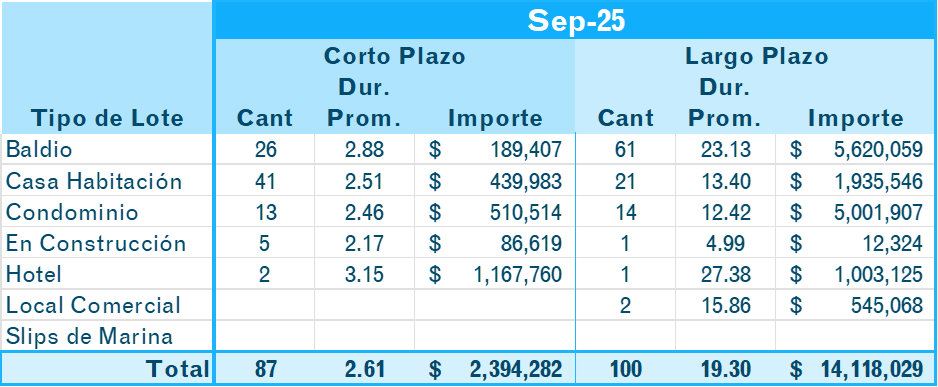

Accounts past due: 207 (Jan) → 170 (Mar) → 187 (Sep)

Share of long-term by amount: 84.8% (Jan) → 86.3% (Mar) → 85.5% (Sep)

Typical time past due:

Short Term - 2.61 quarters

Long Term - 19.30 quarters o 6.4 years

Short-term vs. Long-term debtors

Short-term (≤4 quarters):

Balances moved from $2.52M (Jan) to $2.16M (Mar), then up to $2.39M (Sep). Headcount fell in March and partially recovered by September.

Long-term (>4 quarters):

The backbone of the debt: $14.11M (Jan), $13.62M (Mar), $14.12M (Sep). Even when the number of long-term accounts moved slightly, the amount stayed high and stable.

What this means: Our financial risk largely sits in long-term cases. Every successful conversion of a long-term debtor to current has outsized budget impact.

Where the debt sits

Baldío (vacant lots): 35.2% of total. Accounts trended down since January, but total owed increased by $363K MXN vs. January, suggesting deeper arrears within remaining cases.

Condominio (condo): 33.4% of total. Down $824K vs. January—good progress—but still our #2 exposure.

Casa Habitación (single-family): 14.4% of total, roughly stable year-to-date (-$77K vs. January).

Hotel:13.1% of total, up $501K vs. January; a few large balances dominate.

Local Comercial (commercial): 3.3% of total, roughly flat.

En Construcción (under construction): 0.6% of total, down $122K vs. January; most accounts are short-term and appear to be normalizing as projects advance.

Trends from January → September 2025

Total balance: dipped in March, then returned near January levels by September.

Mix: Long-term remains ~85% of total throughout, so sustained collection on aged accounts is still the main lever.

Category standouts:

Condominio improved the most in pesos (-$824K).

Hotel rose the most (+$501K).

Baldío increased despite fewer accounts, indicating aging.

Notes

Categorization by Duration:

“Short Term” = ≤4 quarters with outstanding balance;

“Long Term” = >4 quarters with outstanding balance.

Rounded figures; amounts in MXN (Mexican pesos)..